The global probiotic ingredients market is anticipated to grow from USD 8 million in 2025 to USD 12 million by 2035, with a CAGR of 3.3%. The growth is driven primarily by the increasing awareness of the benefits of probiotics in gut health, immune system support, and microbiome-based wellness solutions.

As consumers seek functional foods and dietary supplements, the demand for clinically tested probiotic strains is rising. Producers are incorporating advanced formulations and technologies to enhance the stability of probiotics. Initially confined to dairy and supplements, probiotics are expanding into new applications such as sports nutrition, infant health, beauty, and mental well-being.

The increasing recognition of the gut microbiome's crucial role in overall health has been a key factor propelling market development. Probiotics are increasingly viewed as an alternative to medications for controlling digestive, immune, metabolic, and cognitive functions. This trend is fueling the demand for probiotics, particularly for digestive disorders and gut issues caused by modern lifestyles and stress-related health problems.

The market has seen increased demand for psychobiotics for mental health, synbiotics (a combination of probiotics and prebiotics), and postbiotics (probiotic metabolites), adding more diversity to the offerings. Technological innovations are also driving growth in the probiotic ingredients market.

The development of spore-forming probiotics (such as Bacillus strains) has enabled the inclusion of probiotics in shelf-stable foods and beverages. Furthermore, advancements in microencapsulation technology have made it possible to incorporate probiotics into baked goods, chocolates, and ready-to-eat meals, ensuring better viability.

Companies are also introducing more convenient formats like probiotic gummies, effervescent powders, and oral dissolving strips to meet consumer demand for easier-to-consume options. The market is highly competitive, with leading companies like BioGaia AB, Sabinsa Corporation, Lallemand, Inc., Chr. Hansen, DuPont (IFF), Kerry Group, and BioGaia driving innovation and expanding their market share through mergers, acquisitions, and partnerships.

BioGaia AB has shifted strategically by terminating its partnership with its French distributor in Q1 2025 and launching its products directly on major local marketplaces like Bol.com and Amazon.nl, marking its direct entry into the Dutch market. Sabinsa Corporation introduced LactoBeet™ at Expo West 2025, a novel combination of beetroot and probiotic strains for digestive health, while also showcasing its sustainability efforts. Lallemand, Inc. introduced Cerenity™, a clinically studied probiotic formula supporting healthy aging and launched the Innov’Biome challenge to advance probiotic research.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 6.9% |

| H2(2024 to 2034) | 7.3% |

| H1(2025 to 2035) | 7.2% |

| H2(2025 to 2035) | 7.5% |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 6.9% in the first half (H1) of 2024 and then slightly faster at 7.3% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 7.2% in the first half of 2025 and continues to grow at 7.5% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

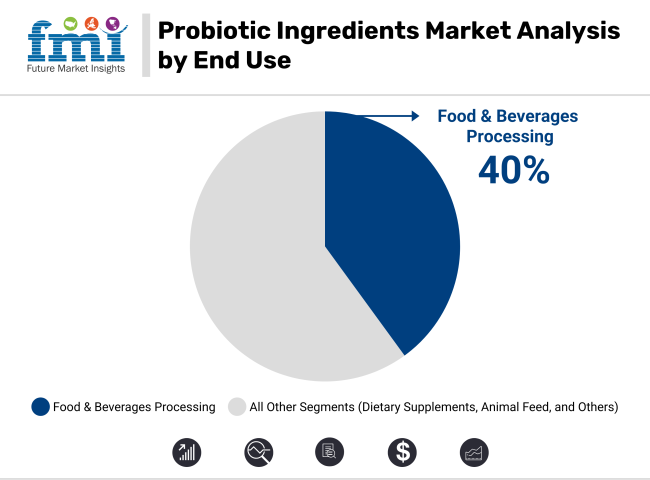

The probiotic ingredients market is set to see substantial growth, driven by key segments such as bacterial strains and food & beverages processing. Bacterial strains are expected to dominate the product type segment, while food & beverages processing will continue to lead in terms of end-use applications. These segments are anticipated to be major contributors to the market’s expansion as the demand for functional ingredients continues to rise.

Bacterial strains are expected to capture 75% of the probiotic ingredients market share by 2025. Probiotic bacterial strains, such as Lactobacillus, Bifidobacterium, and Streptococcus, are the primary ingredients used in probiotic products due to their ability to promote gut health and support overall immune function.

These strains are commonly used in the production of dietary supplements, fermented foods, and functional beverages. Leading companies such as DuPont, Chr. Hansen, and Danisco are major players in providing bacterial strains, with a focus on developing strains that offer specific health benefits.

The growing awareness of the importance of gut health, along with an increasing focus on natural and functional foods, has significantly contributed to the rise in demand for bacterial strains. As consumers increasingly seek products that support digestive health and immunity, the bacterial strains segment is expected to maintain its dominant position in the market, ensuring continued growth in the probiotic ingredients sector.

Food & beverages processing is projected to capture 40% of the probiotic ingredients market share by 2025. The demand for probiotics in food and beverage products has surged due to growing consumer interest in functional and health-promoting ingredients. Probiotics are widely incorporated into dairy products such as yogurt, kefir, and cheese, as well as non-dairy products like juices, plant-based milks, and snacks.

Companies such as Nestlé, Danone, and Yakult have been incorporating probiotic ingredients into their product lines to meet the rising demand for functional foods. The increasing consumer preference for food products that support gut health, immunity, and overall well-being is driving this trend.

Additionally, the growing popularity of fermented foods and beverages in many regions has expanded the applications of probiotics in food processing. As consumer awareness of the health benefits of probiotics continues to grow, the food & beverages processing segment is expected to remain a key driver of growth in the probiotic ingredients market.

Expansion of Psychobiotics for Mental Well-being

The deepening knowledge of the gut-brain axis has introduced psychobiotics, which are the mental health and cognitive function. Research studies reveal that some Lactobacillus and Bifidobacterium strains help the production of neurotransmitters like serotonin and gamma-aminobutyric acid (GABA). GABA is a vital regulator of mood.

Consumers are showing a growing trend in probiotic supplements that are related specifically to stress management, anxiety reduction, and sleep quality. This issue is being driven by the increase and popularity of interventions that do not require pills for a balanced mind.

Companies like Chr. Hansen and DuPont (IFF) have committed themselves to the clinical trials to confirm the claims associated with psychobiotic supplements. For their part, the brands are attaching psychobiotics to functional items like foods, drinks, and dietary supplements which are proposed to contribute to the enhancement of emotional resilience and cognitive clarity.

Growing Demand for Next-Generation Spore-Forming Probiotics

Stored in a refrigerator, traditional probiotic strains such as Lactobacillus and Bifidobacterium tend to perish in severe conditions such as high temperature and acidity. Nonetheless, probiotics that are spore-forming, particularly Bacillus coagulans and Bacillus subtilis, are becoming expected due to their ability to withstand high temperatures, acidic conditions, and long shelf life.

These strains are now being positioned as ideal materials for functional beverages, dietary supplements, and dry food applications. The sports nutrition and pharmaceuticals sectors are mainly pushing the interest in probiotics based on spores as they had been backed up by studies that display their effectiveness not only in the intestines, but also in the body in general, as they regulate immunity and promote digestion.

Major companies like Kerry Group (GanedenBC30®) and Sabinsa Corporation are the frontrunners of the innovation race in this territory, driven by extensive clinical studies and the finding that spore-forming probiotics help restore the gut flora and immunity.

Integration of Probiotics in Sports Performance & Recovery

Athletes and those who are fitness oriented are beginning to appreciate the impact of gut microbiota in performance, endurance, and muscle recovery. The studies found that probiotics improve nutrient absorption, control inflammation, and support the immune system, and thus they are an important tool in sports nutrition applications.

Probiotic strains like Lactobacillus plantarum and Bacillus coagulans are now being incorporated into protein powders, energy bars, sports drinks, and post-workout recovery formulas. The interest of the sports sector in probiotics is seen in their capability to lessen oxidative stress, which is induced by exercise, and muscle damage.

Probi AB and Lallemand Inc. have been the key drivers of research into probiotics concerning the recuperation of athletes. As the industry flourishes, the companies are in the process of launching multi-strain mixtures focused solely on endurance athletes, which correlates with a popular, new trend in sports nutrition that enhances the gut microbiome.

Synbiotic Formulations Driving New Product Innovations

Synbiotics, combinations of probiotics and prebiotics, are changing the way we think about gut health formulations. They improve probiotic survival and efficacy by acting together. While standalone probiotics focus on bacteria only, synbiotics feed the good bacteria directly by providing nutrients through prebiotic fibers such as inulin, fructooligosaccharides (FOS), and galactooligosaccharides (GOS).

The consumer's wish list includes such products that work optimally with pre- and probiotics and at the same time improve their digestive health. Among the major players developing synbiotic products for immunity, metabolic health, and weight loss are Chr. Hansen, IFF (Danisco), and Yakult.

The trend transcends just supplements into functional dairy, plant-based drinks, and meal replacements, which brands feed specific populations, like children, and the elderly, and the athletes with. The scientific acceptance of synbiotics is predicted to speed along their adoption in the fields of both clinical and consumer health.

Expansion of Infant and Early Life Probiotics

An increasing body of research confirming the part that gut bacteria play in infant health has resulted in a similar growth of demand for probiotics for infants and toddlers, that have been claimed to be clinically validated. Parents resort to the natural approach and gut-friendly methods instead of drugs for the control of colic, digestive discomfort, and improving the immune system.

Probiotic strains such as Bifidobacterium breve, Bifidobacterium infantis, and Lactobacillus rhamnosus GG are famous for their therapeutic effects on colic, the strengthening of the immune system, and an increase in gut microbiome diversity during early life.

Infant formula manufacturers are incorporating probiotic strains in baby formulas and liquid drops such as Nestlé (Gerber), Danone (Aptamil), and Morinaga Milk Industry. The maternal probiotics that get the most attention are those that are,vital to a healthy pregnancy, help babies avoid allergies, and females by increasing the proliferation of beneficial gut flora.

Diversification of Probiotic Delivery Formats

Consumers tend to turn away from the conventional formats of probiotics consisting of pills, powders, and fermented dairy products. This has opened up the avenue to new delivery formats that are more convenient and which compliance is higher. The New schedule of probiotic formats like gummies, effervescent powders, oral dissolving strips, chocolates, and probiotic-infused snacks which are found in supermarkets is on the rise.

Their attraction lies in their taste, ease of consumption, and the fact that they tend to contain the probiotic live cells within them that are more stable. Companies like BioGaia, DSM, and Probiotical are bringing in probiotic chewables and functional confectioneries such as gummies targeted at both adults and children.

In addition, the use of microencapsulation technology has helped the goods producers to come up with baked products, breakfast cereals, and shelf-stable snacks with probiotics included without compromising the viability of the probiotics. The shift to a more enjoyable way of taking probiotics is anticipated to increase market size, especially in the gut health and immune markets.

The international probiotic ingredients market consists of the moderate concentration with the Tier 1, Tier 2, and Tier 3 players being very active in competing on the issues of innovation, product efficacy, and market reach.

As the Tier 1 players namely Chr. Hansen, DuPont (IFF), Kerry Group, and BioGaia control the market with their power, and thanks to their resources, they can acquire more companies, drive the R&D agenda and build up extensive distribution networks.

These companies are heavy spenders in the areas of clinical trials, following regulations, and new strain development, so their probiotic ingredients are the most researched and thus the most rated.CHR. Hansen’s merger and acquisition of Novozymes are also the cases in point to mention.

Firms like Lallemand, Probi AB, and Morinaga Milk Industry, are Tier 2 companies and are supporting different regions' probiotic solutions while becoming more global. They dedicate themselves to custom formulations, symbiotic technologies, and stability-enhancing technology, which is what they offer to the industry to make probiotic products more accessible in functional food, infant nutrition, and pharma applications.

Tier 3 justifies the absence of the bigger players, as Deerland Probiotics & Enzymes and Synbio Tech are more of niche companies specially dedicated to the spore-forming strains and the gut health-focused solutions. These businesses are for big, specific consumer needs, such as beauty probiotics, sports performance probiotics, and psychobiotics.

The industry develops through the accomplishments made in cross-industrial collaborations, the introduction of delivery formats, and the scientific breakthroughs that further the competition, through providing a variety of solutions that address the growing consumer demands.

The following table shows the estimated growth rates of the top three countries. USA, China and Germany are set to exhibit high consumption, and CAGRs of 3.8%, 6.3% and 2.5% respectively, through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| United States | 3.8% |

| China | 6.3% |

| Germany | 2.5% |

China, the main consumer of probiotic ingredients, is a market backed by Traditional Chinese Medicine (TCM). The combination of probiotics and the herbal formula is a trend of development as brands take the opportunity of the peoples belief in the holistic healing and gut balance. Manufacturer makes the probiotic blends by adding TCM herbs, like ginseng, astragalus, goji berries, etc. with the benefits of immune, digestive, and energy levels.

All the major companies like By-Health and Inner Mongolia Yili Industrial Group are the ones that are coming up with different kinds of fermented herbal probiotic drinks and capsules. Moreover, the need for probiotics that are personal based on TCM diagnostics is also growing.

As the consumers want functional products that contain only natural ingredients and not many additives, and they prefer the products that promote digestive health, so this fusion of probiotics and ancient medicines is the key to expanding the market.

The USA probiotic market is making a transition from just being in a supplement and dairy category to mainstream food due to the active and health-conscious segment of the population. Consumers are supporting cereals, granola bars, nut butters, and condiments along with the probiotics that gut health benefits in the most convenient formats.

The biggest food companies such as Kellogg's, Nestlé, and General Mills are dealing with spore-forming probiotics which survive the production and storage of these processed foods. The functional probiotics snacks like probiotic popcorn, chips, and chocolate bars, are getting acknowledged as a significant sector.

The main reason that this trend emerges is the increment in the public's understanding of the connection between gut and immune problems; people prefer to eat immune-boosting foods without changing their diets. As digestive health is now a commonly discussed topic, the integration of probiotics into packaged foods is almost routine, and lines between supplements and standard nutrition are blurred.

Germany, which is famous for its strong pharmaceutical and functional food markets, is seeing a rise in probiotics often used for gut inflammation and microbiome-depression disorders. Patients and health professionals are looking for doctor-approved probiotic strains for conditions such as Irritable Bowel Syndrome (IBS), Crohn's disease, and ulcerative colitis.

The pharmaceutical field is becoming the leader in this sphere while SymbioPharm, BioGaia, and Dr.Wolz are the names of the companies that are engaged in making the probiotics that are focused on lowering the intestinal inflammation and on the restoration of the microbiome.

The German consumer's age of scientific trust prevails as they choose the probiotics that have medical backing and get a regulatory approval statement. The projection for the prescription and over-the-counter gut-health medications with probiotics is that they will become more integrated, because the physicians are getting on board with the microbiome treatments for digestive disorders more often.

The probiotic ingredients business is experiencing stiff rivalry as the producers are utilizing tactical creativity, merger and acquisition, and exclusive product launches to remain the leaders. Companies like Chr. Hansen, DuPont (IFF), Kerry Group, and BioGaia are emphasizing on the development of strains that have been clinically proven to work to meet the increased request for personalized and functional probiotics.

Firms are diversifying to non-dairy, sports nutrition, and gut-brain health types of applications in line with the changing tastes and preferences of consumers. The formation of mergers and acquisitions that impact the market such as the IFF merger with the DuPont Nutrition and Biosciences and the partnership of Chr. Hansen with Novozymes that foster the biotech knowledge are the main players.

Further, enterprises are employing microencapsulation technology for the first time to maintain consistency in the probiotic delivery system in convenience foods and beverages. Manufacturers are fielding more and more products, gaining a strategic upper hand through increased R&D, and more prominent distribution networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8 million |

| Market Size in 2035 | USD 12 million |

| CAGR (2025 to 2035) | 3.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Types Analyzed | Bacterial (Lactobacillus, Bacillus, Enterococcus, Bifidobacterium, Streptococcus, Others), Yeast (Saccharomyces Cerevisiae, Saccharomyces Boulardii) |

| End-Use Categories Analyzed | Food & Beverages Processing (Bakery & Confectionery, Breakfast Solutions, Cultured Dairy Products, Ice Cream & Frozen Desserts, Snacks & Bars, Infant Nutrition, Beverages & Dairy Drinks), Dietary Supplements (Immune Health, Gut & Digestive Health, Women's Health), Personal Care & Cosmetics, Animal Feed |

| Product Forms Analyzed | Powder, Suspension, Granule, Capsule, Stick Pack, Tablet/Chewable, Gel |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Key Players influencing the Market | BioGaia AB, Sabinsa Corporation, Lallemand, Inc., LeSaffre, S.A., Probi AB, DowDuPont Inc., Ganeden, Inc., Probiotics International Ltd., Novonesis Group, Koninklijke DSM NV, Others |

| Additional Attributes | Dollar sales by product type (bacterial vs yeast), Dollar sales by end-use (food & beverages, dietary supplements, etc.), Growth trends in immune health vs gut health applications, Regional demand dynamics across North America, Europe, and Asia-Pacific |

The global probiotic ingredients market is valued at USD 8 million in 2025.

The United States is anticipated to be the leading consumer of probiotic ingredients, with a projected valuation of USD 12 million by 2035.

The growing consumer preference for functional foods and dietary supplements promoting gut health is the current market trend.

Chr. Hansen A/S, Danisco A/S, Lallemand, Inc., LeSaffre, S.A., and Probi AB are the key players operating in the probiotic ingredients market.

Explore Functional Food Ingredients Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.